In his white paper, Somanathan B. Nathan, Director, Client Operations, explores providers’ need to prioritize streamlining processes over insurance denial management.

Please click on the video to the right to learn more about Somanathan, his paper’s key takeaways, and his motivation for writing on this subject.

To discuss this white paper, please contact Somanathan using his information provided at the bottom of the page.

Revenue cycle processes have had to continuously evolve over the years to keep pace with the rapid changes occurring in the healthcare industry. As a result, RCM vendor partners are now utilizing technology that hospitals do not have access to on their own. To be successful in this new climate of increasingly complex payment models, providers need to focus more on how to streamline their processes to optimize reimbursement rather than on insurance denial management.

Leveraging the technology available through end-to-end partners is one way to achieve this. Automation tools address some of the most pervasive issues in today’s revenue cycle landscape and allow healthcare facilities to spend less time focusing on payments, and more on patients.

In a survey of 1,000 practicing physicians conducted by the American Medical Association (AMA), 86% of doctors described the burden of prior authorizations as extremely high. Nearly an equal amount (88 %) also said the burden has increased over the last five years.

Prior authorization is one of the best use cases for artificial intelligence in healthcare right now. The transactional nature of prior authorizations makes it an ideal candidate for AI technology, which can leverage real-time analytics and machine learning to identify cases needing prior authorization, submit requests to payers, and check statuses.

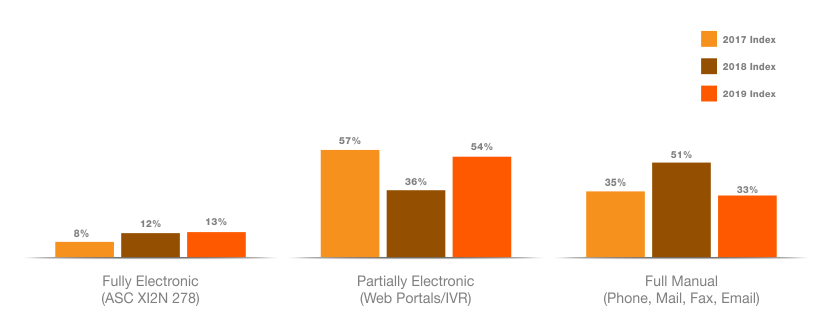

Electronic prior authorization adoption continues to lag, according to the latest Council for Affordable Quality Healthcare, Inc. (CAQH) Index.

AI can do this by imitating intelligent human behavior through algorithms that find patterns and plan future actions to produce a positive outcome. This differs from other emerging technologies like machine learning or robotic process automation, which can identify patterns like AI but focus on improving accuracy rather than achieving positive outcomes. These other technologies also have no or limited ability to plan a future action beyond the task at hand.

Therefore, AI’s “intelligence” can effectively address the most pressing revenue cycle management issues, such as prior authorizations, claim status checks, and out-of-pocket cost estimates, all while getting the information that needs human intervention to the right person at the right time.

Such benefits would be a welcome addition to the business side of healthcare. Currently, confusion reigns supreme on both the patient and provider sides when it comes to patient payments. Patients' frustration is well documented, and on the providers' side, payment reconciliation and settlement are still largely tedious, manual processes that take place across multiple systems. As a result, neither patients nor providers get true visibility into where they stand financially.

Add to that, the fact that the U.S. banking system, for the most part, is still not set up to work easily with clinical systems. The inescapable conclusion is that current healthcare payment systems, which have been designed around payer payments, need to be redesigned from the ground up to solve for patient payments, which constitute the fastest growing piece of the healthcare revenue pie.

The good news is that innovative payment solutions are coming to help healthcare organizations get the most out of their patient payment stream. These solutions enable hospitals and health systems to capture a bigger slice of the patient payment pie and to help patients better understand their healthcare bills. These solutions work across multiple different practice-management and health information systems, promoting greater efficiency and effectiveness.

Indeed, with these technology solutions, both the patient and provider can get, for the first time, a complete financial picture of the patient encounter.

Because both sides enjoy a clearer picture of what to expect financially from a given episode of care, providers and patients can openly discuss payment concerns and options that are good for both parties. The enterprise realizes more satisfied patients who are more likely to settle their financial obligations promptly and gets a clearer, more comprehensive and accurate picture of patient payment status. This institutional knowledge, in turn, leads to better revenue management and results.

Enterprises get greater reliability on the payment collection side (technology never "calls in sick") and the billing office comes to know and understand their patients' entire financial obligations for a given episode of care across all providers.

Reduced A/R days and improved cash flow are the lifeblood of any healthcare organization. More than ever before, hospitals need assistance navigating increasingly complex payment models. A successful denial management process is not about working denials as they occur, but rather systematically gathering the data required to eliminate them. Descriptive analytics technology can effectively cure the root cause of denials, rather than addressing the symptoms.

Descriptive analytics is a preliminary stage of data processing that creates a summary of historical data to prove insights into trends and causes. Descriptive data analytics tools can enable your organization to thoroughly analyze your 835 files and provide robust reporting that can result in actionable steps that greatly reduce days in A/R. By tracking every claim that has been denied, you can quickly identify trends that can be used to establish billing rules specific enough to dramatically improve first-time billing of the claim and to prevent future denials.

Most provider systems do not actively track denials and staffs are often overwhelmed with data that is difficult to utilize. Descriptive analytics tools can capture data properly, allowing you to determine the cause of low reimbursement rates rather than focusing on appealing individual denials.

The issues of reduced reimbursement, increasing denial rates and bad debt are expected to continue, if not get worse. To leverage these technologies, among many others, more hospitals than ever before are opting to partner with end-to-end revenue cycle management vendors like Vee Healthtek.